In this second wave of this year's new releases, which will be published progressively from October 2022 to March 2023In addition, improvements in the generation of reports with Excel and Power BIthe improvement in the integration with Power Apps and Power Automate and new supply chain functionalities, among other things. Read on to find out all the details in depth.

– New ways to create grouped actions: Groups of preferred shares: It will be possible to create a preferred stock group where the stocks we mark as preferred will appear. As always, existing groups can be added or new groups can be added in the page extensions and will have backward compatibility.

– Uso de ByRef, parámetros Odata en XMLPorts: If you work with OData services in Business Central and especially with the independent actions, you already know that there are certain shortcomings in procedures with parameters defined by reference and parameters of type XmlPort.

- Improvements when updating the code in the extensions: When refactoring an app, it is common to move a field from one table to another. With this new enhancement, the developer can copy the data from an old field to the new one using update codeunits, in a set-based manner without the need to write a loop. A new "datatype" is expected in AL for this scenario.

- Restore a deleted environment: This enhancement provides a grace time to recover already deleted environments. When an environment is deleted, it remains in stand-by for 7 days before it is permanently deleted. An administrator user will be able to restore the deleted environment before it is completely deleted.

- Improved integration of document attachments in Power Apps and Power Automate It makes it easier to manage and interact with attachments, images and other business-related documents.

– Choose the format of a report: The new report design option allows users to select, via a drop-down menu, the different report designs available.

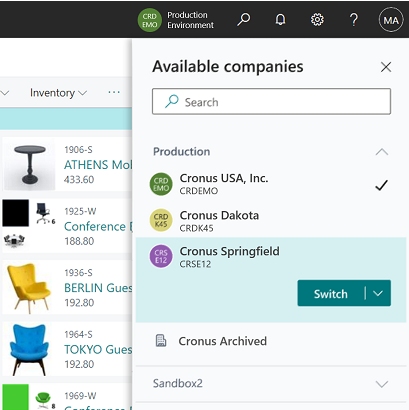

- Alternate companies between different environments: It allows to select between different companies according to the environment. This will be possible thanks to an integrated switcher that will appear in the dropdown bar of the "Companies available":

Development tools: has moved completely to Visual Studio Code, where improvements in developer productivity are expected.

Application: Shopify integration continues to be improved.

Country and region: BC will be available in more countries and regions.

Power Platform: More efficient automation with Power Automate so users can configure workflows for the specific needs of their organization.

In this way, they can more efficiently recover the books from errors that may occur. As with other journal entries, the user must first cancel the settlement of the entries manually.

For companies that use payments by checkThe new feature will now have multiple remittance addresses available for suppliers and better bank reconciliation. But this new feature will not only be available for check payments but will also be implemented so that suppliers do not have to send one at a time and multiple senders can be selected at once.

Variants of a financial report can be stored as separate reports. The main functionality is the same, but the name changes make it easier to understand the concepts. New templates for row and column definitions will be available in future version updates.

Excel designs for reports that can be chosen on the report request page.

In addition to Excel's design capabilities, a finance API is being created that can be used in both Excel and Power BI.

In this way, users can create their own more detailed analysis on general ledger data and L/M budgets with dimensions.

A new Power BI application template will be provided that is based on the new API. The application will be published on the BCTech Samples GitHub repository for users who want to start generating reports in Power BI.

Extended text functionality for VAT clauses: The extended text feature is implemented in VAT clauses, so that if a country requires longer text, customers can type the text as extended text. Users can also see the text printed on sales and purchase reports.

New VAT date field in documents and entries: Users can report VAT returns and refunds based on the new VAT Date instead of the Registration Date to meet the requirements of certain countries.

If you use the page Payment reconciliation journal to record and apply customer payments, you can configure the journal to use a specific number series. This option provides the possibility to reverse the transactions that were recorded through the payment reconciliation journal from the Recording of accounting transactions. For example, it might be useful to reverse entries if you applied a payment to the wrong customer.

These have not been all the details of Wave 2 so far, but we will keep you posted as we get official information from Microsoft.

Calculate IPNR manually?

Forget about it, with our solution you will be able to automate processes to present the tax liquidation to the AEAT.

Have you already read our Wave 1 section?

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR cookie consent add-on, this cookie is used to record the user's consent to cookies in the "Advertising" category. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by the GDPR cookie consent add-on. The cookie is used to store user consent for cookies in the "Analytics" category. |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by the GDPR cookie consent to record user consent for cookies in the "Functional" category. |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by the GDPR cookie consent add-on. Cookies are used to store user consent for cookies in the "Required" category. |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by the GDPR cookie consent add-on. The cookie is used to store user consent for cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by the GDPR cookie consent add-on. The cookie is used to store user consent for cookies in the "Performance" category. |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the WordPress theme of the website. It allows the website owner to deploy or change the content of the website in real time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR cookie consent add-on and is used to store whether or not the user has consented to the use of cookies. It does not store any personal data. |

| wpEmojiSettingsSupports | session | WordPress sets this cookie when a user interacts with emojis on a WordPress site. It helps determine if the user's browser can display emojis properly. |

| Cookie | Duration | Description |

|---|---|---|

| _gat | 2 minutes | Google Universal Analytics sets this cookie to restrain request rate and thus limit data collection on high-traffic sites. |

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | 2 years | YouTube sets this cookie through embedded YouTube videos and records anonymous statistical data. |

| _ga | 1 year 1 month 4 days 1 minute | Google Analytics sets this cookie to calculate visitor, session and campaign data and track site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognise unique visitors. |

| _ga_* | 1 year 1 month 4 days 1 minute | Google Analytics sets this cookie to store and count page views. |

| _gid | 1 day 1 minute | Google Analytics sets this cookie to store information on how visitors use a website while also creating an analytics report of the website's performance. Some of the collected data includes the number of visitors, their source, and the pages they visit anonymously. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the old or new player interface. |

| VISITOR_PRIVACY_METADATA | 6 months | YouTube sets this cookie to store the user's cookie consent state for the current domain. |

| YSC | session | The YSC cookie is set by Youtube and is used to track views of videos embedded in Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt.innertube::nextId | never | YouTube sets this cookie to register a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | YouTube sets this cookie to register a unique ID to store data on what videos from YouTube the user has seen. |

¿El IPNR te preocupa?

PUES NO TE PREOCUPES MÁS, LO SOLUCIONAMOS

El impuesto sobre plásticos no reutilizables ya ha entrado en vigor este 1 de enero.

Desde Adderit hemos desarrollado una herramienta única en el mercado para que puedas estar al día con la hacienda.

Nosotros te guiamos para que puedas registrar las operaciones que realices sujetas al nuevo impuesto

sin problemas ni contratiempos.