Adderit IRPF for Dynamics 365 Business Central

DESCRIPTION

The module Adderit IRPF para Dynamics 365 Business Central complements the functionality of the system by allowing the calculation of withholdings on different tax concepts and the generation of integrated forms with the Spanish Tax Agency.

Details of the withholdings applicable in the current financial year can be consulted in the following table Tax Agency website

PARAMETERISATION

Withholding tax configuration

For the correct operation of the extension it will be necessary to configure the table of "Withholding configuration"with the different types of withholdings to be used in the system. For this purpose, the information provided by the Tax Agency shall be used as a basis.

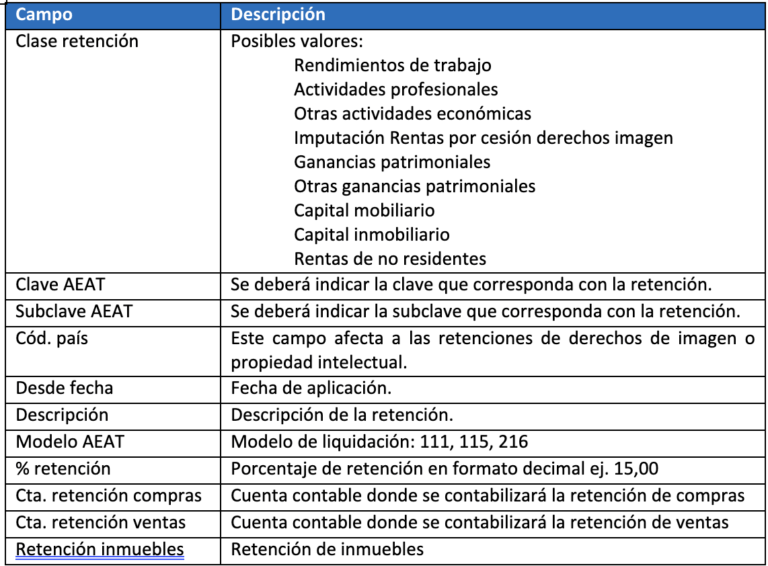

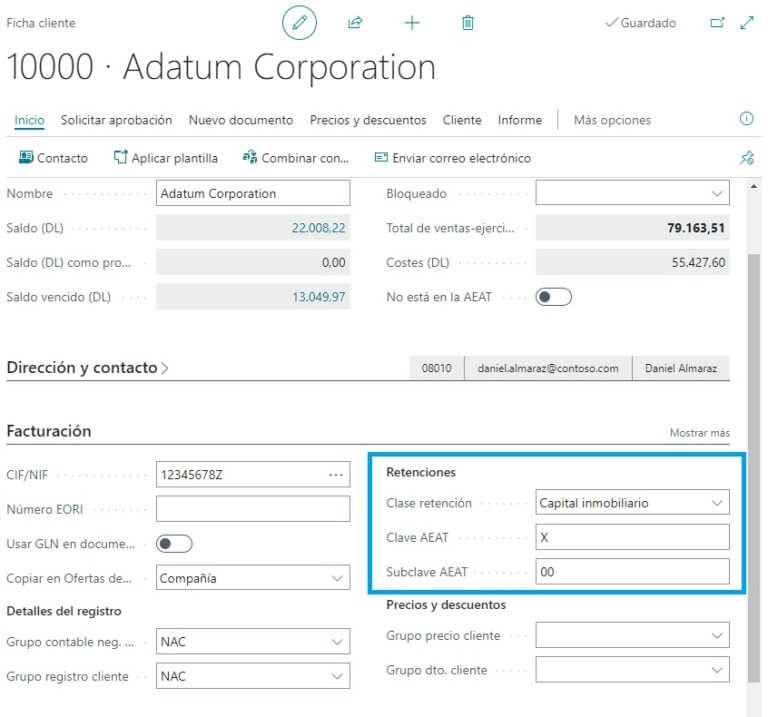

The following fields shall be indicated in this table:

The following registers are given as examples:

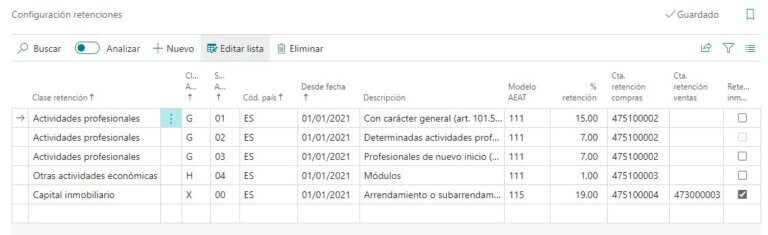

Suppliers

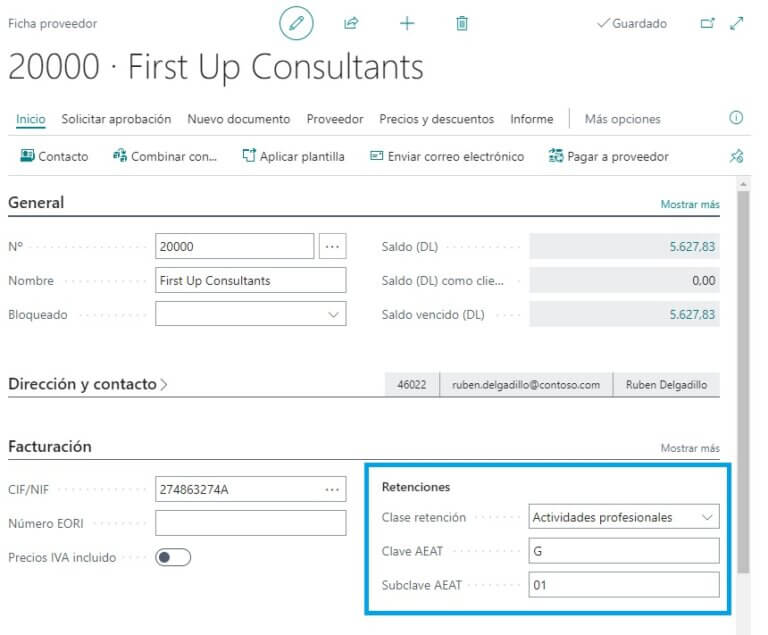

Clients

Real estate

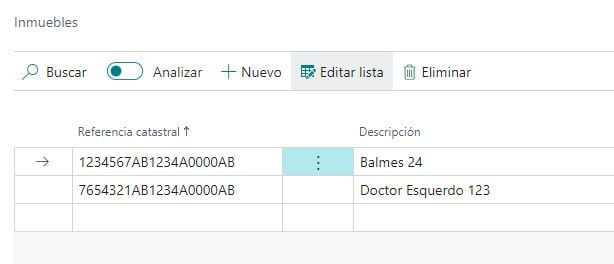

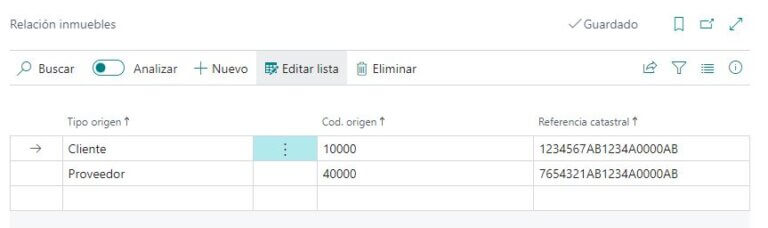

For the withholding of real estate, it is necessary to set up the table of "Real estate"with the different cadastral references.

And configure their relationship with suppliers or customers, as appropriate, in the table "Real estate relationship"

Operational

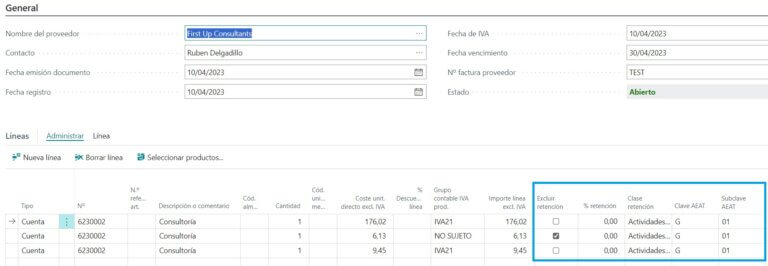

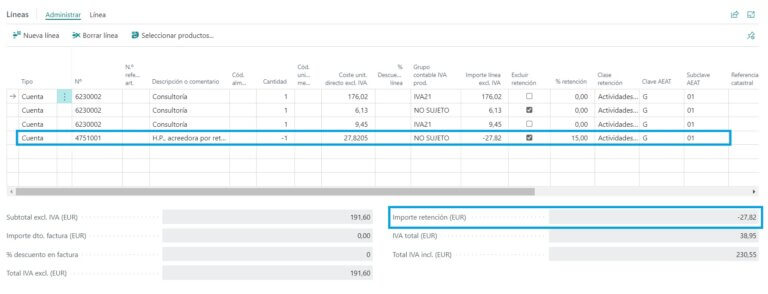

When launching the document, the system will calculate the corresponding withholdings according to the configuration of the table "Withholding configuration"generating the lines corresponding to the withholdings in the document itself, and showing the values of the withholdings in the document summary. The system will create as many withholding lines as there are AEAT Key and AEAT Subkey groupings in the document.

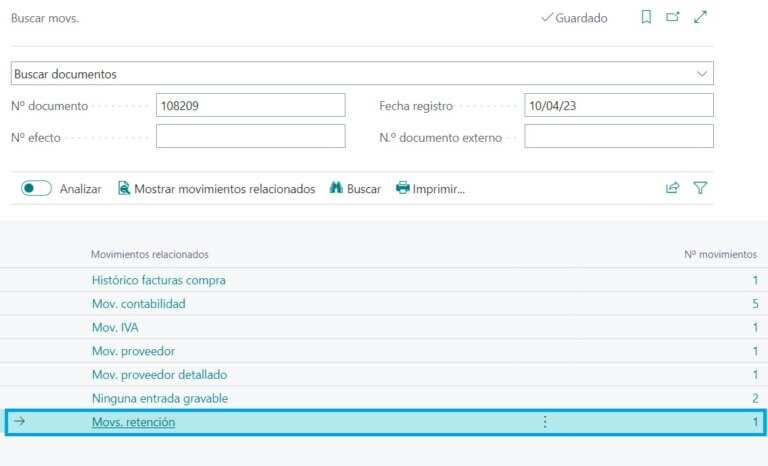

After the document is registered, the system automatically, in addition to the posting of the withholdings to the corresponding accounts configured in the table "Withholding configuration", will generate the withholding movements associated with the document.

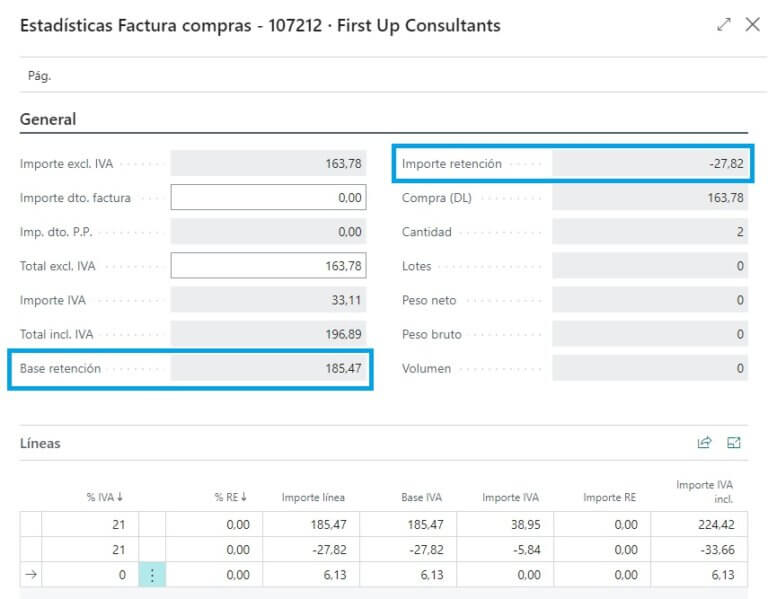

Through the document statistics option, you can see the basis for withholdings as well as the amount of withholdings. Each time you access the document statistics, the system recalculates the values and updates the document.

In the sales invoice, when reporting a cadastral reference at header level, this reference will be replicated to the lines.

When creating a sales line if the combination of Withholding Type, AEAT Key and AEAT Subkey are marked as Withholding in Withholding Configuration the value reported in the cadastral reference field of the header will be retrieved.

Control of withholding taxes

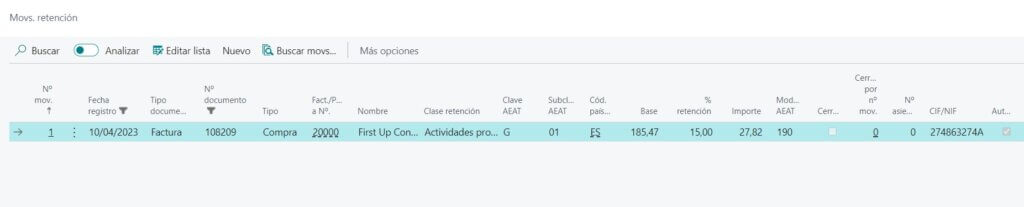

On the screen of "Movs. retention" includes all the information relating to each movement in order to be able to generate the files to be submitted to the Tax Agency.

Access to the export of XML Facturae files can be found in Hist. Sales Invoices and in Hist. Sales Credit Memos.

The action is called "Create Facturae". and can be found both in the file and in the list.

File generation

Under no circumstances do the files generated by the system replace the returns to be filed with the Tax Agency; they are help files to complete the information available in the system and it is the final responsibility of the user to validate and complement the necessary information that is not included in the files.

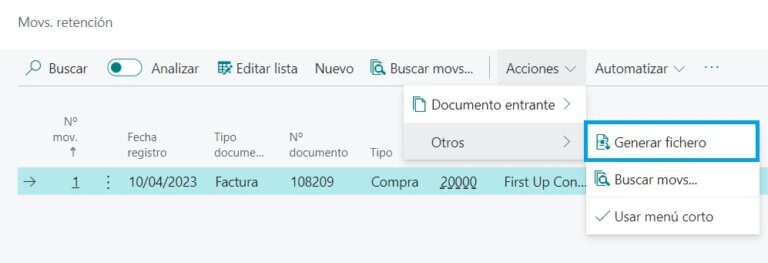

In order to generate these files, from the "Movs. retention" in the section Actions -> File generation, the AEAT file generation process will be launched.

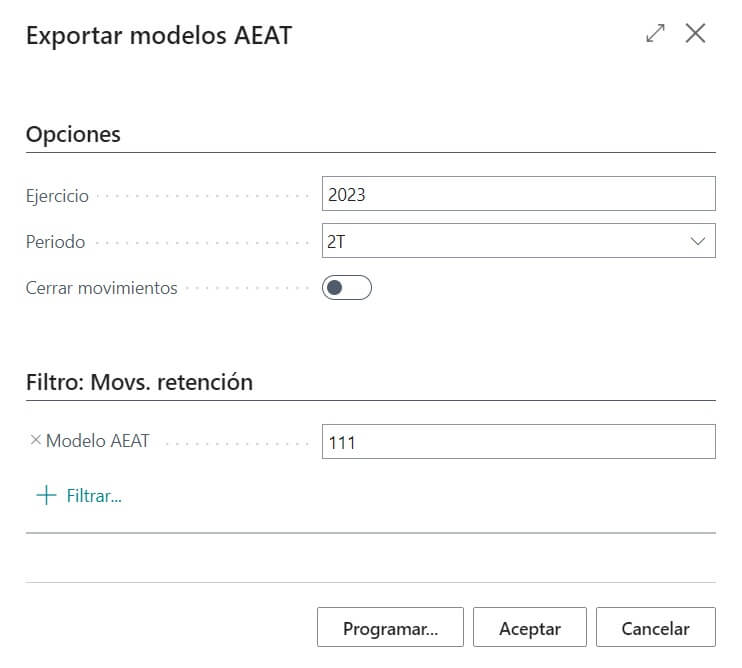

Generation of monthly or quarterly files

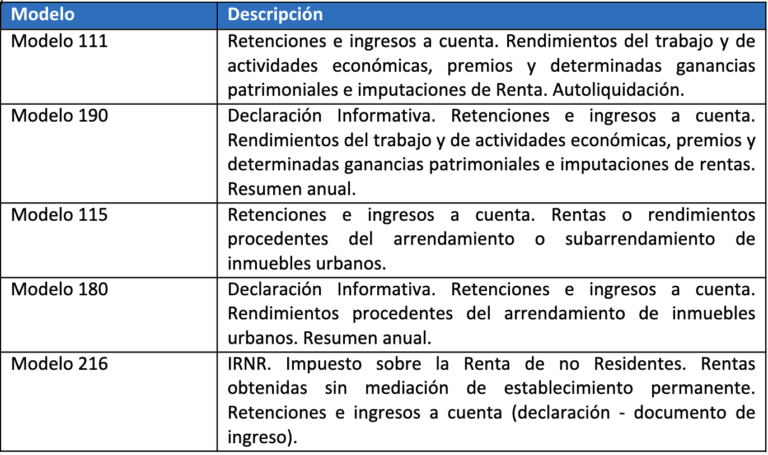

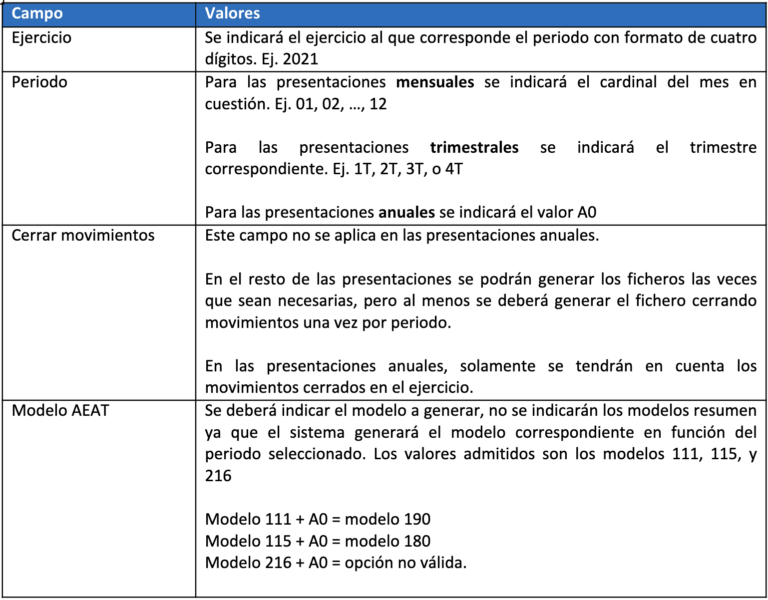

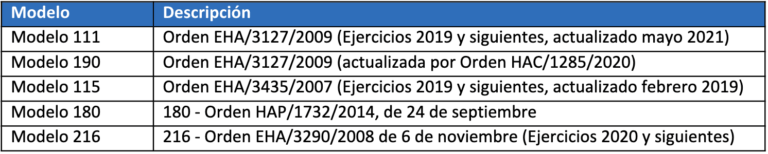

For the generation of the monthly or quarterly models, the Fiscal Year, the Period, and the AEAT Model to be generated must be indicated. Optionally, you can indicate whether you wish to close the movements.

For the generation of the annual summary forms, the Fiscal Year must be indicated, the Period will be "A0", and the AEAT Form (monthly or quarterly e.g. 111, 115, etc.). The movements included in the financial year must have been previously closed.

Integration with SII

Invoices or sales credits that contain a line with a reported cadastral reference, when exporting the XML of the SII will include a new block for each different cadastral reference found in the document:

<sii:DatosInmueble>

<sii:DetalleInmueble>

<sii:SituacionInmueble>1</sii:SituacionInmueble>

<sii:ReferenciaCatastral>Cadastral reference</sii:ReferenciaCatastral>

</sii:DetalleInmueble>

</sii:DatosInmueble>

Up to 15 different cadastral references are allowed in the same document.

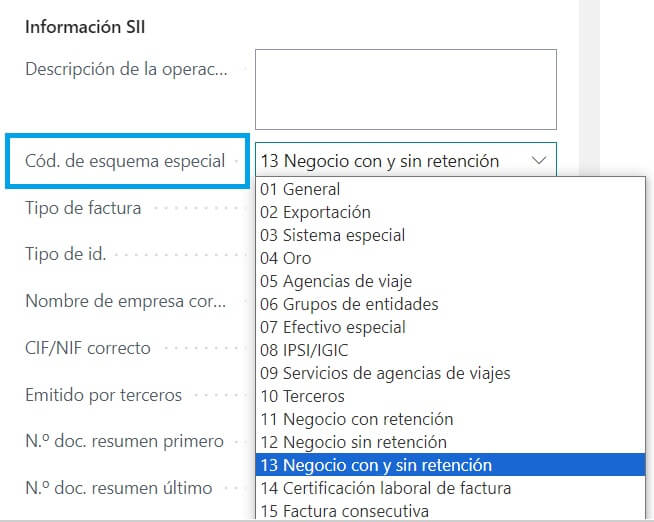

It should be noted that in sales documents where cadastral references are included the field "Special Scheme Code" must be 12 or 13:

Otherwise the SII will return this error:

Error if there is no KeySpecialSchemeSpecialRegimeOTranscendence or KeySpecialRegimeSpecialTranscendenceAdditionall with value 12 or 13 and the Real Estate block is included.

If you need our help to install the application or if you have any questions, please contact us via the form.

You can also call us on the telephone numbers below or send us an email.

Contact

Central Mail

Barcelona Office

Trafalgar street, nº 4, 5º B,

08010 Barcelona

Barcelona telephone

(+34) 938 323 134

Madrid Office

Paseo de la Castellana (Azca) 79, 28046 Madrid

Madrid telephone

(+34) 910 971 702