E-invoicing is a modern approach that seeks to streamline and optimise business processes, reduce the use of paper and improve efficiency in business transactions

Mandatory electronic invoicing is a process involving the issuing, receipt, transmission and archiving of invoices in digital format.instead of using physical paper documents.

In summary, una factura electrónica es un fichero encriptado y seguro que se exporta en forma XML.

La facturación electrónica garantiza la seguridad y autenticidad de tus documentos contables.

En caso de Adderit Facturae, podrás exportar las facturas y abonos de venta como ficheros XML con formato Facturae versión 3.2.2, con la posibilidad de llevar incluida la firma digital.

¡Importante!

Que NO es una factura electrónica:

«Ley Crea y Crece» is the new Law of Creation and Growth of Companies, approved by the Congress of Deputies on 15 September 2022. This law imposes the obligation on companies and self-employed individuals to implement electronic invoicing in their entities.

There are different types of electronic invoices:

A quien afecta

Cuando entra en vigor

Additionally:

Veri*factu

Esta funcionalidad está prevista ser incorporada en el Business Central directamente por parte de Microsoft.

*It has been mandatory since January 2015.

The following are some of the key issues involved in e-invoicing:

1. Issuance of Electronic Invoices: Instead of printing paper invoices, companies generate invoices in electronic format, which can be PDF, XML or other compatible formats with electronic invoicing systems. These invoices include detailed information on the products or services sold, prices, taxes, dates and details of the sender and receiver.

Do you need to submit #invoices electronically? Our extension,- Adderit Facturae has an integrated option to create files in PDF and XML format.

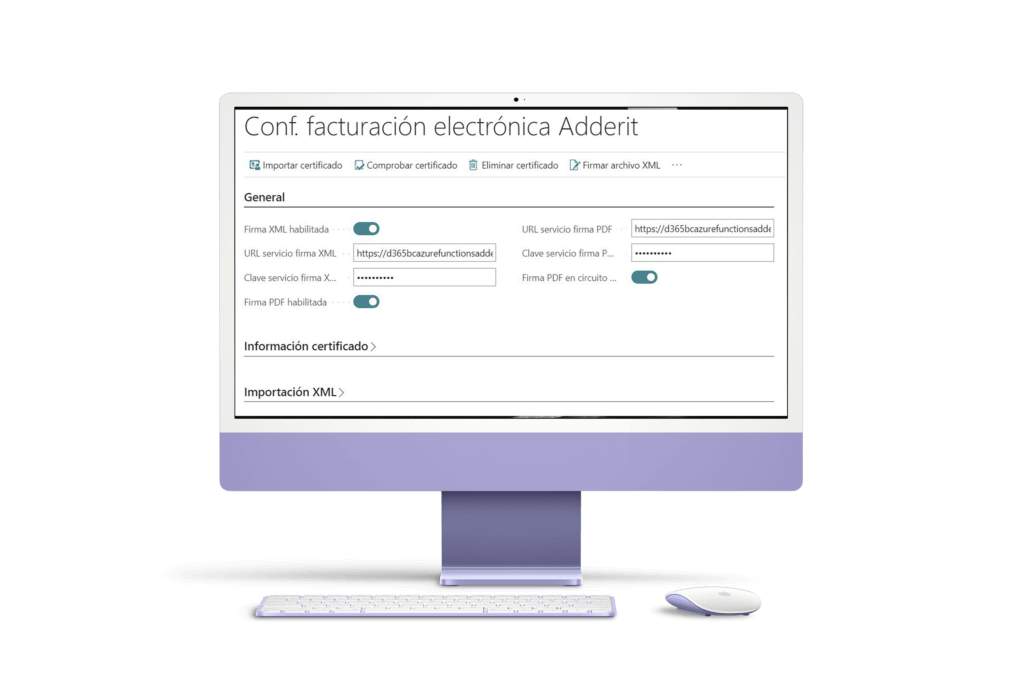

2. Electronic signature: To ensure the authenticity and integrity of electronic invoices, many jurisdictions require invoices to be electronically signed using digital certificates. The electronic signature ensures that the invoice has not been altered since its issuance and originates from the legitimate issuing entity.

Adderit Facturae allows you to export files with the digital signature included from Business Central.

3. Transmission: Once an electronic invoice is issued, it is also transmitted to the recipient electronically.

This can be done directly through Business Central with our module Adderit Facturae.

4. Receipt of Electronic Invoices: The recipient of the electronic invoice must have the capacity to receive and process these documents electronically. This implies having systems or software that enable the reading, validation and recording of electronic invoices in the accounting books.

With formats mentioned in point 1, you will have no problem sending files in the format required by the recipient.

5. Digital Archive: Electronic invoices must be digitally archived in accordance with the current tax and legal regulations in each country. This ensures that the documents are available for auditing and compliance with tax obligations during the required period.

This measure will not only help companies reduce their carbon footprint but also save on expenses related to paper invoice production, storage, and shipping. Additionally, it helps to avoid any possible human errors.

6. Regulatory Compliance: Electronic invoicing is subject to specific regulations and requirements in each country. Companies must comply with local tax laws and regulations governing the issuance and retention of electronic invoices.

Adderit, as your consultants, we will go hand in hand with you to keep you up to date with the regulations, always complying with the requirements of this new law.

7. Beneficios: Electronic invoicing offers several advantages, including cost reduction in printing and shipping, streamlining processes, decreasing manual errors, improving inventory management, and reducing tax evasion, among other benefits.

Electronic invoicing is a process that replaces paper invoices with digital documents, involving various technical and legal aspects that must be managed appropriately to comply with local regulations and reap the associated benefits of this invoicing method.

AUTOMATIZA LA LIQUIDACIÓN DEL IEPNR

¿Calcular el IEPNR manualmente?

Forget about it, with our solution you will be able to automate processes to present the tax liquidation to the AEAT.

It also allows the integration of invoices received in XML Facturae format and the digital signature of invoices in PDF format.

And much more.

You can read more about E-invoicing here

Adderit Facturae helps you become more efficient, reduce costs, improve cash flow and comply with legal and tax requirements, while minimizing environmental impact and facilitating the management of business documents

By 2024, do all companies need to implement e-invoicing?

¿Cuándo entra en vigor Verif*actu?

¿Es obligatorio enviar Factura electrónica a todos mis clientes?

According to the law, sólo es obligatorio enviar las facturas a clientes que lo piden, no es necesario enviarlas a todos tus clientes, a menos que sea administración pública.

¿Un PDF firmado representa una factura electrónica?

If so, does Microsoft not offer a standard option?

Why choose to use Adderit Facturae and not something standard from Microsoft?

Do you have any further questions? We are here to solve them, do not hesitate to write to us:

adderit@adderit.es

Or call us:

Madrid: 910 971 702 | Barcelona: 938 323 134

You can try our module for free for a limited time, after which the following fees will apply:

Flat rate: 9€ (up to 30 documents per month).

From 30 documents per month, additional fees ranging from €0.30 (31-499 documents/month) to €0.01 (3,000-9,999 documents/month) per document apply.

After 30 documents, additional fees apply, check and calculate your fee here: https://adderit.es/es/adderit-facturae-factura-electronica/

And contact us to get all the information you need and try our module for free:

Madrid: 910 971 702 | Barcelona: 938 323 134

adderit@adderit.es

Available now on AppSource: Adderit Facturae

You can leave your details in the following form and we will be sure to contact you as soon as possible.

Reference links:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Advertisement" category. |

| cookielawinfo-checkbox-analytics | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Analytics" category. |

| cookielawinfo-checkbox-functional | 1 year | The GDPR Cookie Consent plugin sets the cookie to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Necessary" category. |

| cookielawinfo-checkbox-others | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores user consent for cookies in the category "Others". |

| cookielawinfo-checkbox-performance | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores the user consent for cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | CookieYes sets this cookie to record the default button state of the corresponding category and the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | The website's WordPress theme uses this cookie. It allows the website owner to implement or change the website's content in real-time. |

| rc::a | never | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| rc::c | session | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| Cookie | Duration | Description |

|---|---|---|

| yt-remote-cast-installed | session | The yt-remote-cast-installed cookie is used to store the user's video player preferences using embedded YouTube video. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-fast-check-period | session | The yt-remote-fast-check-period cookie is used by YouTube to store the user's video player preferences for embedded YouTube videos. |

| yt-remote-session-app | session | The yt-remote-session-app cookie is used by YouTube to store user preferences and information about the interface of the embedded YouTube video player. |

| yt-remote-session-name | session | The yt-remote-session-name cookie is used by YouTube to store the user's video player preferences using embedded YouTube video. |

| ytidb::LAST_RESULT_ENTRY_KEY | never | The cookie ytidb::LAST_RESULT_ENTRY_KEY is used by YouTube to store the last search result entry that was clicked by the user. This information is used to improve the user experience by providing more relevant search results in the future. |

| Cookie | Duration | Description |

|---|---|---|

| ANONCHK | 10 minutes | Indica si el MUID se transfiere a ANID, una cookie utilizada para publicidad. Clarity no usa ANID, por lo que siempre se establece en 0. |

| CLID | 1 year | Microsoft Clarity’s cookies send us non-personally identifiable information such as session data. |

| MR | 7 days | Indica si se debe actualizar el MUID. |

| MUID | 1 year | Identifica navegadores web únicos que visitan sitios de Microsoft. Estas cookies se utilizan para publicidad, análisis del sitio y otros fines operativos. |

| SM | 90 days | Se utiliza para sincronizar el MUID en los dominios de Microsoft. |

| _clck | 1 year | Mantiene el ID de usuario de Clarity y las preferencias únicas para ese sitio. Asegura que las visitas posteriores al mismo sitio se atribuyan al mismo ID de usuario. |

| _clsk | 24 hours | Conecta múltiples vistas de página de un usuario en una sola grabación de sesión de Clarity. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 6 months | YouTube sets this cookie to measure bandwidth, determining whether the user gets the new or old player interface. |

| VISITOR_PRIVACY_METADATA | 6 months | YouTube sets this cookie to store the user's cookie consent state for the current domain. |

| YSC | session | Youtube sets this cookie to track the views of embedded videos on Youtube pages. |

¿El IEPNR te preocupa?

TENEMOS SOLUCIÓN

El impuesto sobre plásticos no reutilizables está en vigor desde el 1 de enero de 2023.

Desde Adderit hemos desarrollado una extensión para Microsoft Dynamics 365 Business Central para que puedas estar al día con la hacienda.

Te guiamos para que puedas registrar las operaciones que realices sujetas al nuevo impuesto

sin problemas ni contratiempos.