We were fortunate to have the participation of our outstanding Consultant, Abel Robledo, who acted as speaker and shared his experience and knowledge on the subject. We would like to take this opportunity to thank all the participants for dedicating their valuable time to learn about our solution.

During the webinar, we had the opportunity to explore the key features and benefits of Adderit IEPNR. This innovative solution is specifically designed to facilitate the calculation of the Tax on non-reusable plastic packagingproviding an efficient and accurate tool for companies.

Some of the topics covered during the event included:

1. Configuración del módulo IEPNR.

2. Configuration of the types of operation.

3. Configuration of master files: Products, Customers, Suppliers and Warehouses.

4. Operaciones afectadas por IEPNR en ventas, compras y producción.

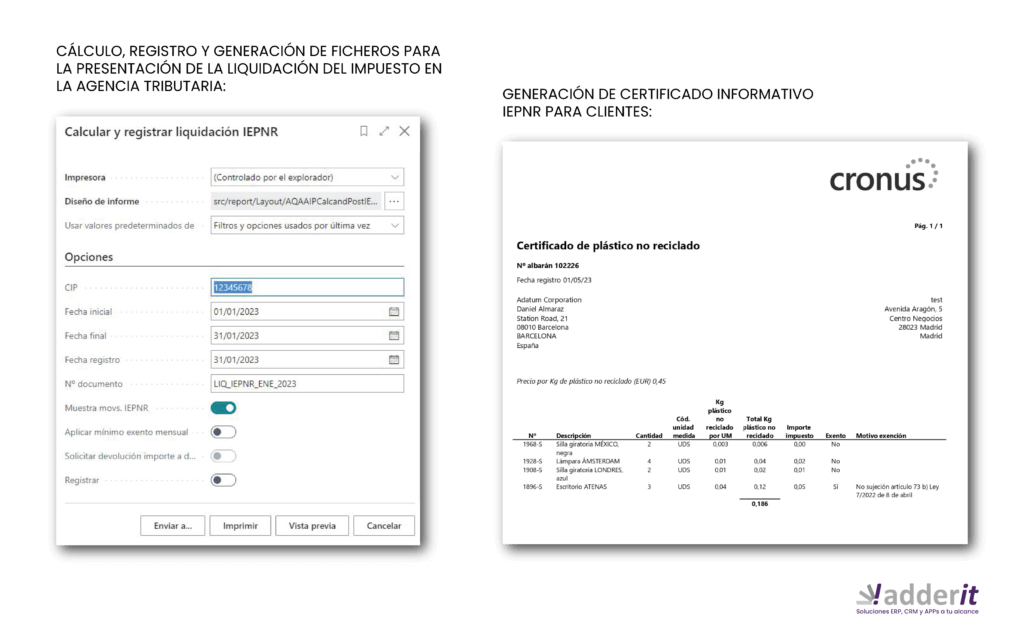

5. Tax liquidation.

In addition, our module Adderit IEPNR is available from AppSource, the Microsoft Dynamics 365 Business Central app store. You can find more information and download the module through the following link.

And not only that, we offer a free 5-day license for you to try the complete module without restrictions. Aprovecha esta oportunidad para explorar todas las funcionalidades y beneficios que ofrece nuestra extensión IEPNR.

Si deseas obtener más detalles sobre Adderit IEPNR y su integración con Business Central, te invitamos a leer nuestro artículo completo HERE

1. How much does the Business Central module cost?

The price depends on whether you want a monthly or annual subscription:

You can also install the module for free from AppSource, by typing in the search engine Adderit. We offer a free 5-day license to test the complete module with NO restrictions.

Then you can contact us through the following e-mail address iepnr@adderit.es to extend the license.

2. If I install this module now, what happens to the transactions and operations I have performed during the year?

There is no problem because the generation of iepnr movements can be performed at any time at the user's request by simply executing the movement generation process indicating a period of dates. These iepnr movements are created from the product movements that have been created by the standard system in the requested period.

3. Is it possible to buy plastic from a national manufacturer, use this plastic to manufacture my products and then sell these products to the EU? In this case, it would be necessary to request the refund of the tax that the national manufacturer has charged me, model A22.

The case of refunds is not currently contemplated in the module. Our module is designed to facilitate the management of the liquidation of the tax to companies that are obliged by the AEAT to such liquidation. Conceptually, a company not subject to the tax will not install the module.

For any additional questions about this aspect, you can contact us via e-mail iepnr@adderit.es

4. Is there any file generated for the electronic filing of the tax?

Yes, csv format files are generated, both from the iepnr transaction screen and from the iepnr stock transaction screen by clicking on the settlement transaction or the closing transaction.

5. If I need to present the declaration of the plastic in customs and the supplier does not inform it in packing list/invoice but for now he informs me of the kg, can I generate the document from the purchase delivery note as in the sale? In order not to do it by hand:

This is not currently included in the module.

6. In the case that I buy in China (Export) I am introducing plastic in my country, it is necessary to configure it in the VAT reg groups? ->

No, the tax in this case is paid with the SAD.

7. You indicate that it is for BC cloud, any plan for older versions?

At the moment it is not planned, we are focused on improving the SaaS version. In the future we do not rule out adding older versions.

AUTOMATIZA LA LIQUIDACIÓN DEL IEPNR

¿Calcular el IEPNR manualmente?

Forget about it, with our solution you will be able to automate processes to present the tax liquidation to the AEAT.

We don't want you to miss any of our future updates and events related to Adderit. We encourage you to subscribe to our newsletter to stay up to date and receive exclusive information. You can subscribe through the following link.

If you have any additional questions or need more information, please do not hesitate to contact our team of experts. We will be happy to help you and provide you with the support you need.

We look forward to seeing you at our future events and sharing with you more details about our innovative solutions!

Sources: AEAT IEPNR

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Advertisement" category. |

| cookielawinfo-checkbox-analytics | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Analytics" category. |

| cookielawinfo-checkbox-functional | 1 year | The GDPR Cookie Consent plugin sets the cookie to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Necessary" category. |

| cookielawinfo-checkbox-others | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores user consent for cookies in the category "Others". |

| cookielawinfo-checkbox-performance | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores the user consent for cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | CookieYes sets this cookie to record the default button state of the corresponding category and the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | The website's WordPress theme uses this cookie. It allows the website owner to implement or change the website's content in real-time. |

| rc::a | never | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| rc::c | session | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| Cookie | Duration | Description |

|---|---|---|

| yt-remote-cast-installed | session | The yt-remote-cast-installed cookie is used to store the user's video player preferences using embedded YouTube video. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-fast-check-period | session | The yt-remote-fast-check-period cookie is used by YouTube to store the user's video player preferences for embedded YouTube videos. |

| yt-remote-session-app | session | The yt-remote-session-app cookie is used by YouTube to store user preferences and information about the interface of the embedded YouTube video player. |

| yt-remote-session-name | session | The yt-remote-session-name cookie is used by YouTube to store the user's video player preferences using embedded YouTube video. |

| ytidb::LAST_RESULT_ENTRY_KEY | never | The cookie ytidb::LAST_RESULT_ENTRY_KEY is used by YouTube to store the last search result entry that was clicked by the user. This information is used to improve the user experience by providing more relevant search results in the future. |

| Cookie | Duration | Description |

|---|---|---|

| ANONCHK | 10 minutes | Indica si el MUID se transfiere a ANID, una cookie utilizada para publicidad. Clarity no usa ANID, por lo que siempre se establece en 0. |

| CLID | 1 year | Microsoft Clarity’s cookies send us non-personally identifiable information such as session data. |

| MR | 7 days | Indica si se debe actualizar el MUID. |

| MUID | 1 year | Identifica navegadores web únicos que visitan sitios de Microsoft. Estas cookies se utilizan para publicidad, análisis del sitio y otros fines operativos. |

| SM | 90 days | Se utiliza para sincronizar el MUID en los dominios de Microsoft. |

| _clck | 1 year | Mantiene el ID de usuario de Clarity y las preferencias únicas para ese sitio. Asegura que las visitas posteriores al mismo sitio se atribuyan al mismo ID de usuario. |

| _clsk | 24 hours | Conecta múltiples vistas de página de un usuario en una sola grabación de sesión de Clarity. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 6 months | YouTube sets this cookie to measure bandwidth, determining whether the user gets the new or old player interface. |

| VISITOR_PRIVACY_METADATA | 6 months | YouTube sets this cookie to store the user's cookie consent state for the current domain. |

| YSC | session | Youtube sets this cookie to track the views of embedded videos on Youtube pages. |

¿El IEPNR te preocupa?

TENEMOS SOLUCIÓN

El impuesto sobre plásticos no reutilizables está en vigor desde el 1 de enero de 2023.

Desde Adderit hemos desarrollado una extensión para Microsoft Dynamics 365 Business Central para que puedas estar al día con la hacienda.

Te guiamos para que puedas registrar las operaciones que realices sujetas al nuevo impuesto

sin problemas ni contratiempos.