In this second wave of this year's new releases, which will be published progressively from October 2022 to March 2023In addition, improvements in the generation of reports with Excel and Power BIthe improvement in the integration with Power Apps and Power Automate and new supply chain functionalities, among other things. Read on to find out all the details in depth.

– New ways to create grouped actions: Groups of preferred shares: It will be possible to create a preferred stock group where the stocks we mark as preferred will appear. As always, existing groups can be added or new groups can be added in the page extensions and will have backward compatibility.

– Uso de ByRef, parámetros Odata en XMLPorts: If you work with OData services in Business Central and especially with the independent actions, you already know that there are certain shortcomings in procedures with parameters defined by reference and parameters of type XmlPort.

- Improvements when updating the code in the extensions: When refactoring an app, it is common to move a field from one table to another. With this new enhancement, the developer can copy the data from an old field to the new one using update codeunits, in a set-based manner without the need to write a loop. A new "datatype" is expected in AL for this scenario.

- Restore a deleted environment: This enhancement provides a grace time to recover already deleted environments. When an environment is deleted, it remains in stand-by for 7 days before it is permanently deleted. An administrator user will be able to restore the deleted environment before it is completely deleted.

- Improved integration of document attachments in Power Apps and Power Automate It makes it easier to manage and interact with attachments, images and other business-related documents.

– Choose the format of a report: The new report design option allows users to select, via a drop-down menu, the different report designs available.

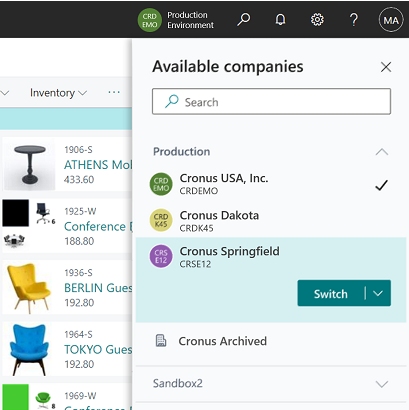

- Alternate companies between different environments: It allows to select between different companies according to the environment. This will be possible thanks to an integrated switcher that will appear in the dropdown bar of the "Companies available":

Development tools: has moved completely to Visual Studio Code, where improvements in developer productivity are expected.

Application: Shopify integration continues to be improved.

Country and region: BC will be available in more countries and regions.

Power Platform: More efficient automation with Power Automate so users can configure workflows for the specific needs of their organization.

In this way, they can more efficiently recover the books from errors that may occur. As with other journal entries, the user must first cancel the settlement of the entries manually.

For companies that use payments by checkThe new feature will now have multiple remittance addresses available for suppliers and better bank reconciliation. But this new feature will not only be available for check payments but will also be implemented so that suppliers do not have to send one at a time and multiple senders can be selected at once.

Variants of a financial report can be stored as separate reports. The main functionality is the same, but the name changes make it easier to understand the concepts. New templates for row and column definitions will be available in future version updates.

Excel designs for reports that can be chosen on the report request page.

In addition to Excel's design capabilities, a finance API is being created that can be used in both Excel and Power BI.

In this way, users can create their own more detailed analysis on general ledger data and L/M budgets with dimensions.

A new Power BI application template will be provided that is based on the new API. The application will be published on the BCTech Samples GitHub repository for users who want to start generating reports in Power BI.

Extended text functionality for VAT clauses: The extended text feature is implemented in VAT clauses, so that if a country requires longer text, customers can type the text as extended text. Users can also see the text printed on sales and purchase reports.

New VAT date field in documents and entries: Users can report VAT returns and refunds based on the new VAT Date instead of the Registration Date to meet the requirements of certain countries.

If you use the page Payment reconciliation journal to record and apply customer payments, you can configure the journal to use a specific number series. This option provides the possibility to reverse the transactions that were recorded through the payment reconciliation journal from the Recording of accounting transactions. For example, it might be useful to reverse entries if you applied a payment to the wrong customer.

These have not been all the details of Wave 2 so far, but we will keep you posted as we get official information from Microsoft.

AUTOMATIZA LA LIQUIDACIÓN DEL IEPNR

¿Calcular el IEPNR manualmente?

Forget about it, with our solution you will be able to automate processes to present the tax liquidation to the AEAT.

Have you already read our Wave 1 section?

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Advertisement" category. |

| cookielawinfo-checkbox-analytics | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Analytics" category. |

| cookielawinfo-checkbox-functional | 1 year | The GDPR Cookie Consent plugin sets the cookie to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Necessary" category. |

| cookielawinfo-checkbox-others | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores user consent for cookies in the category "Others". |

| cookielawinfo-checkbox-performance | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores the user consent for cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | CookieYes sets this cookie to record the default button state of the corresponding category and the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | The website's WordPress theme uses this cookie. It allows the website owner to implement or change the website's content in real-time. |

| rc::a | never | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| rc::c | session | This cookie is set by the Google recaptcha service to identify bots to protect the website against malicious spam attacks. |

| Cookie | Duration | Description |

|---|---|---|

| yt-remote-cast-installed | session | The yt-remote-cast-installed cookie is used to store the user's video player preferences using embedded YouTube video. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-fast-check-period | session | The yt-remote-fast-check-period cookie is used by YouTube to store the user's video player preferences for embedded YouTube videos. |

| yt-remote-session-app | session | The yt-remote-session-app cookie is used by YouTube to store user preferences and information about the interface of the embedded YouTube video player. |

| yt-remote-session-name | session | The yt-remote-session-name cookie is used by YouTube to store the user's video player preferences using embedded YouTube video. |

| ytidb::LAST_RESULT_ENTRY_KEY | never | The cookie ytidb::LAST_RESULT_ENTRY_KEY is used by YouTube to store the last search result entry that was clicked by the user. This information is used to improve the user experience by providing more relevant search results in the future. |

| Cookie | Duration | Description |

|---|---|---|

| ANONCHK | 10 minutes | Indica si el MUID se transfiere a ANID, una cookie utilizada para publicidad. Clarity no usa ANID, por lo que siempre se establece en 0. |

| CLID | 1 year | Microsoft Clarity’s cookies send us non-personally identifiable information such as session data. |

| MR | 7 days | Indica si se debe actualizar el MUID. |

| MUID | 1 year | Identifica navegadores web únicos que visitan sitios de Microsoft. Estas cookies se utilizan para publicidad, análisis del sitio y otros fines operativos. |

| SM | 90 days | Se utiliza para sincronizar el MUID en los dominios de Microsoft. |

| _clck | 1 year | Mantiene el ID de usuario de Clarity y las preferencias únicas para ese sitio. Asegura que las visitas posteriores al mismo sitio se atribuyan al mismo ID de usuario. |

| _clsk | 24 hours | Conecta múltiples vistas de página de un usuario en una sola grabación de sesión de Clarity. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 6 months | YouTube sets this cookie to measure bandwidth, determining whether the user gets the new or old player interface. |

| VISITOR_PRIVACY_METADATA | 6 months | YouTube sets this cookie to store the user's cookie consent state for the current domain. |

| YSC | session | Youtube sets this cookie to track the views of embedded videos on Youtube pages. |

¿El IEPNR te preocupa?

TENEMOS SOLUCIÓN

El impuesto sobre plásticos no reutilizables está en vigor desde el 1 de enero de 2023.

Desde Adderit hemos desarrollado una extensión para Microsoft Dynamics 365 Business Central para que puedas estar al día con la hacienda.

Te guiamos para que puedas registrar las operaciones que realices sujetas al nuevo impuesto

sin problemas ni contratiempos.