Adderit Verifactu

Get ready for mandatory electronic invoicing 2027!

Comply with the AEAT Verifactu regulation with a secure, automated system

fully integrated with Dynamics 365 Business Central.

What is Verifactu?

Verifactu is the new mandatory electronic invoicing system approved by the AEAT, which requires sending each invoice to the tax authority in real time, receiving its validation, and generating an official QR code that certifies the document’s traceability.

A partir de 2027, todas las empresas y autónomos que facturen digitalmente deberán utilizar un software que:

• Envíe la factura a la AEAT de forma automática

• Espere la validación inmediata

• Genere un QR único para cada factura

• Garantice integridad, seguridad y trazabilidad

Adderit Verifactu incorpora estos requisitos directamente dentro de Microsoft Dynamics 365 Business Central.

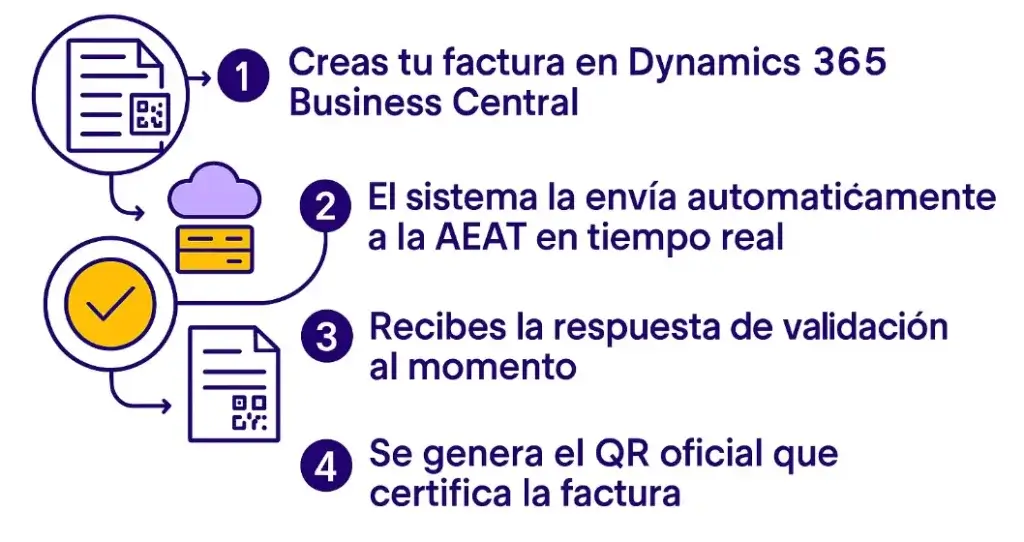

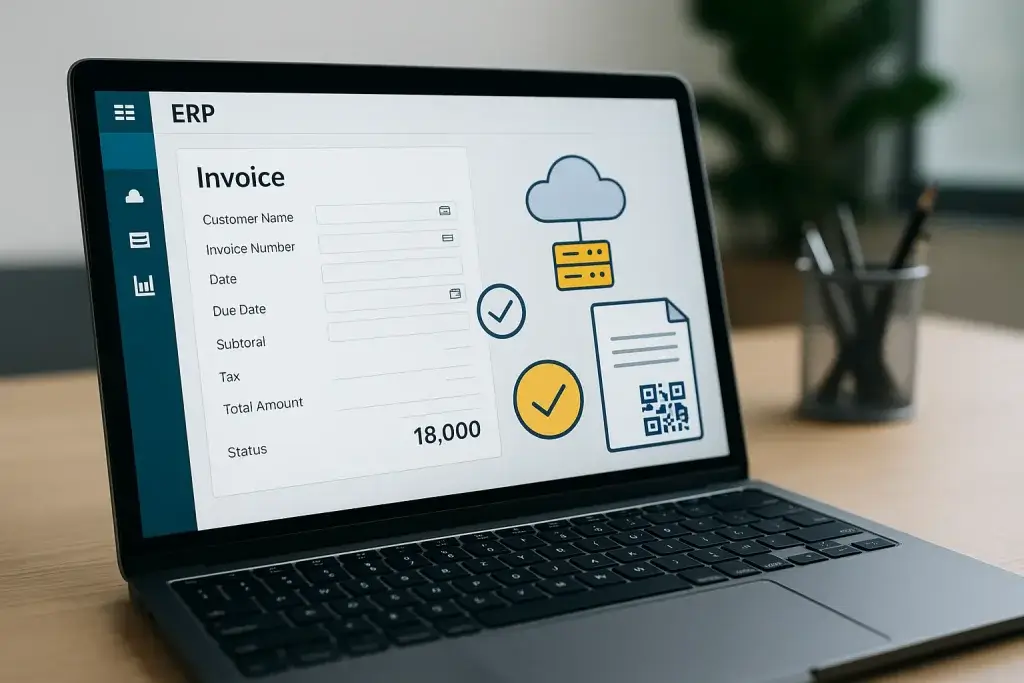

How does Verifactu work?

1. You create your invoice in Dynamics 365 Business Central.

2. The system sends it automatically to the AEAT in real time.

3. You receive the validation response instantly.

4. The official QR code that certifies the invoice is generated.

Benefits for Dynamics 365 Business Central

- Native integration with Dynamics 365 Business Central

- Full process automation: no manual steps required

- Zero errors thanks to automatic validations

- Guaranteed regulatory compliance para 2027

- Full traceability with official QR code

- Immediate adoption: no migrations, no changes to your workflows

- Optimized performance for high-volume invoicing processes

Implementation with Adderit

The process is designed to ensure your company is fully prepared without friction:

Initial review of your Dynamics 365 Business Central

Configuration of the Verifactu workflow

Real-time submission to the AEAT

Hands-on training for your team

Updates & support

Expert solution in Dynamics 365 Business Central and compliance AEAT

Who is affected?

- Companies: mandatory from July enero de 2027.

- Self-employed professionals: mandatory from July julio de 2027.

Exceptions:

- Companies using the SII system

- Basque Country

- Navarre

Why adapt now?

Avoid sanctions and operational blocks

Minimize risks before the critical date

Ensure continuity of your invoicing

Train your team with enough time

Run tests without pressure

Avoid last-minute issues

Guarantee full compliance from day one

Adderit Advantages:

Why choose us?

Certified experts in Dynamics 365 Business Central

Solution available on AppSource

Specialized consultants in Spanish digital tax compliance

Technical and functional team with experience in critical deployments

Architecture ready para 2027 y futuras normativas AEAT

Direct support for your Dynamics 365 Business Central

DISCOVER OUR EXTENSIONS FOR ERP BUSINESS CENTRAL

Frequently Asked Questions (FAQs)

1. Is my company required to use Verifactu?

Sí, todas las empresas y autónomos deberán adaptarse a partir de 2027, salvo excepciones (SII, País Vasco y Navarra)

2. What happens if I don’t adapt in time?

Risk of penalties, interruption of invoicing, and loss of legal validity for unvalidated invoices.

3. Does it work with any ERP?

No. Adderit Verifactu is specifically designed for Dynamics 365 Business Central (SaaS)..

4. What does the free audit include?

A review of your Dynamics 365 Business Central environment, analysis of your invoicing workflow, and implementation recommendations.

5. What happens if the AEAT rejects an invoice?

The system immediately displays the reason for rejection and allows correction without interrupting your workflow.

6. ¿Cómo funciona el código QR?

The QR contains control and traceability information that the AEAT can verify at any time.

7. ¿Podré seguir usando mis plantillas de factura actuales?

Yes. The solution incorporates the legal layer without affecting your usual design.

8. ¿Está la solución certificada?

Yes, it meets the official AEAT requirements for Verifactu systems.

9. ¿Añade carga de trabajo a mi equipo?

No. The entire process is automatic and transparent for the user.

10. ¿Necesito cambiar mi sistema de facturación?

No. The integration is done directly within Dynamics 365 Business Central.

2027 está a la vuelta de la esquina 🚀

Avoid penalties and ensure compliance starting today!