Adderit FacturaE

E-invoice management in Dynamics 365 Business Central

Extensión de facturación que permite exportar facturas y

abonos de venta en formato XML Facturae 3.2.2 con firma digital integrada.

¡Cumple con la normativa de facturación electrónica sin procesos manuales adicionales!

Prueba la extensión totalmente gratis

Quienes están obligado a emitir facturas electrónicas:

- Empresas que realizan operaciones B2B.

- Empresas que facturan a la administración pública.

- Sectores regulados.

- Pymes, grandes corporaciones y autónomos.

✅ Obligación establecida por la Ley Crea y Crece.

✅ Compatible con la Agencia Estatal de Administración Tributaria (AEAT).

¿Qué es FacturaE?

La factura electrónica es un documento legal que certifica la entrega de bienes o servicios y que, en lugar de imprimirse, se genera, firma y almacena de forma electrónica.

With Adderit FacturaE podrás:

Exportar facturas y abonos en formato XML Facturae 3.2.2.

Incluir firma digital de forma automática.

Enviar y validar los documentos directamente en FACe.

👉 Todo desde tu ERP, sin herramientas externas.

¿A partir de cuándo será obligatorio?

Depending on the size of the company, different implementation deadlines have been foreseen:

- December 2024: companies with a turnover of 8 million annually, according to official information.

- December 2025: companies with a turnover of less than 8 million per year, according to official information.

*Según la ley, sólo es obligatorio enviar las facturas a clientes que lo piden, no es necesario enviarlas a todos tus clientes, a menos que sea administración pública

Adderit FacturaE

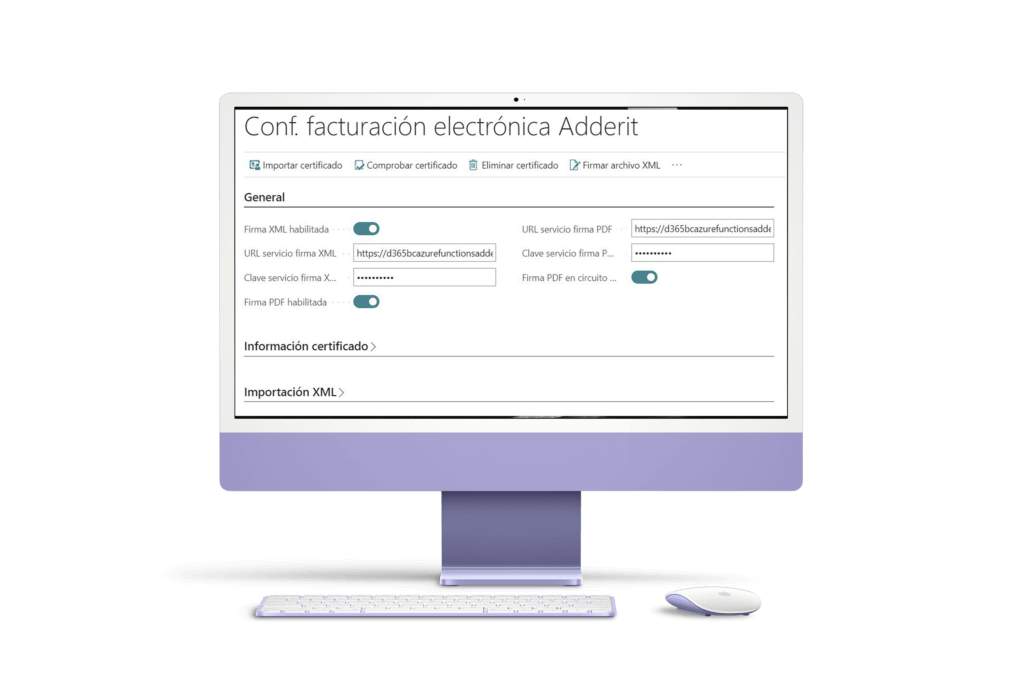

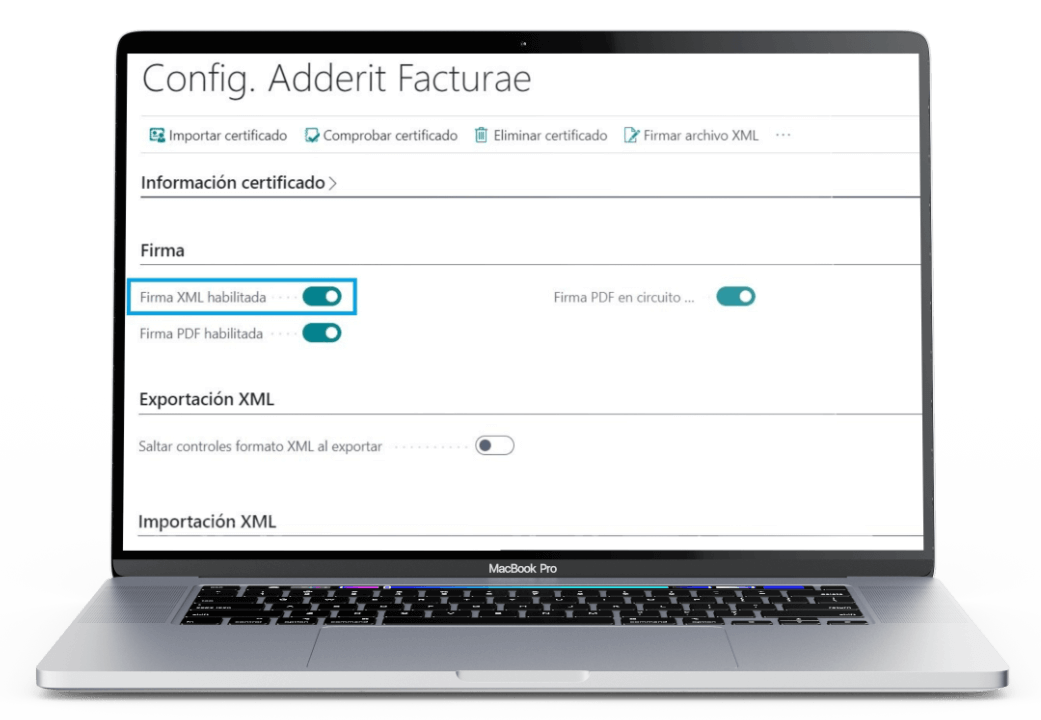

La extensión de Factura Electrónica para Dynamics 365 Business Central complementa la funcionalidad del sistema permitiendo export invoices and sales credits as XML files in Facturae version 3.2.2.2 format and with the possibility of including a digital signature.

You can use the official validator available at the Facturae application site to validate the files.

Discover the advantages

- Efficiency and time saving: Automate invoicing and save time on paperwork.

- Send invoices and credit notes directly: to the FACe platform from Business Central.

- Cost savings: Reduce paper, printing, postage and physical storage costs.

- Speed in the payment process: It facilitates faster payments and improves cash flow.

- Fewer errors: Minimises data entry errors and prevents disputes.

- Tax compliance: Complies with tax and legal regulations, avoiding penalties.

- Access to real-time data: It allows you to make informed decisions with the most up-to-date information.

RATES

Our Adderit InvoiceE extension for Business Central is easy to install and requires no external support. Furthermore, we are committed to keeping it up to date and continuously improving it to meet the needs of all our customers.

Flat rate: 9€ (Hasta 30 documentos al mes no se aplica tarifa adicional).

From 30 documents al mes, se aplican tarifas adicionales: De 31-499 documentos al mes se aplica tarifa adicional de 0,30€ por documento y de 3000 documentos en adelante al mes se aplica tarifa adicional de 0,01€ por documento.

Para más información sobre nuestras tarifas y condiciones, no dudes en contactarnos en facturae@adderit.es. Estaremos encantados de proporcionarte todas las tarifas disponibles para cada tramo.

CALCULATE YOUR RATE:

[Prices excl. VAT]

Our rates

[Prices excl. VAT]

0,30€ per document.

0,25€ per document.

0,20€ per document.

0,15€ per document.

0,10€ per document.

0,05€ per document.

0,03€ per document.

0,01€ per document.

Your trusted Microsoft Dynamics 365 Partner in Barcelona and Madrid

Características de la extensión

Save time and resources with Adderit InvoiceE:

Export invoices and sales credit memos as XML files in Facturae format

Export PDF files with digital signature included.

Easy and quick start-up

Save the cost of printing and sending paper invoices

Signing invoices for sales, services, etc.

It provides current information to make informed decisions.

Our customers have already implemented it, ccontact us to integrate the Adderit InvoiceE solution:.

descubre NUESTRas extensiones PARA ERP BUSINESS CENTRAL

OUR MICROSOFT DESIGNATIONS AND SPECIALIZATIONS

Proceso de implementación de la extensión

Our methodology is based on pre-planning and organising tasks and requirements in order to, using our experience, accompany and guide our clients towards the solution approach that best suits their objectives

> Strategic consultancy

We help you define your digital vision and develop a roadmap to achieve it.

> Custom software development

We create customized applications and solutions that meet your specific needs.

> Technology implementation

We help you integrate new technologies into your business efficiently and effectively.

> Support and maintenance

We offer you a comprehensive technical support service to guarantee the proper functioning of your systems.

Find out more about managing e-invoicing in your ERP Business Central and how we can help you with the process, CONTACT US NOW today